“Mark Zuckerberg’s interest in Metaverse is to connect with consumers directly, without relying on Apple or Google.”

This is an analysis released by the American IT media Record immediately after Mark Zuckerberg, Meta CEO, declared ‘Metaverse First’ last year. It was analyzed that Facebook’s ‘meta transformation’, which seemed a bit odd, was actually a measure that came out of a desperate survival instinct.

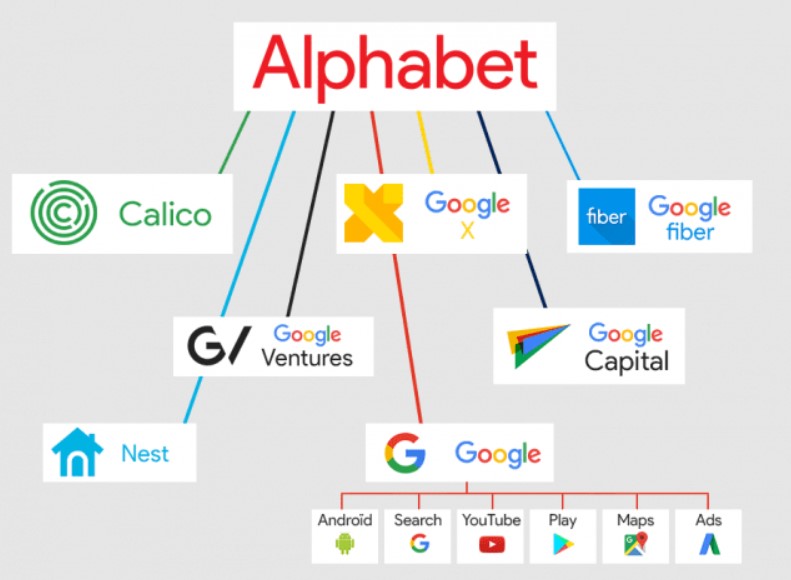

It is considered a very unusual measure for Facebook to change the company name to ‘Meta’. Of course, there is also the case of Google changing its name to Alphabet. However, Google had a strong intention to clearly differentiate between Google, a key revenue stream, and other growth sectors. The intention was to offset Google’s profitability from being obscured by future industries such as self-driving cars.

On the other hand, Facebook just changed the company name to Meta. Of course, in the meta, there are other services besides Facebook, such as Instagram and WhatsApp. There is also Reality Labs, which is in charge of future growth areas such as virtual reality (VR) and augmented reality (AR).

However, the company structure of Facebook is slightly different from that of Google. Under Alphabet, there are various independent companies such as DeepMind, Calico, Waymo, and Google Fever. On the other hand, in the meta, Facebook is virtually everything.

In this situation, instead of the attractive brand ‘Facebook’, the brand was replaced with a rather unfamiliar brand called ‘Meta’.

Unlike Google, which seeks to clarify its corporate structure, Facebook’s corporate name change is related to changes in its ‘philosophy’ and ‘future vision’. The new company name, Meta, contains the ambition to take a leap forward from the world’s top social media company to a ‘leading company in the metaverse’.

■ Facebook’s Crisis Caused by Apple’s App Tracking Transparency

Why did Facebook, which has nothing to envy, come up with a new vision while changing the company name when it was at its peak? The answer to this question is contained in the commotion that occurred on the 3rd (local time) when the stock price of Meta plummeted by about 26% .

On this day, the meta recorded the biggest one-day drop for a single company in the history of the U.S. stock market, losing $237 billion in market capitalization. An amount equivalent to the market capitalization of major IT companies such as Oracle and Cisco has evaporated.

The basic business model of Facebook, the axis of meta, is customized advertisements based on user information. Advertisements displayed by Facebook based on massive big data were highly effective while maximizing users’ reactions.

However, this business model effectively collapsed when Apple introduced its App Tracking Transparency (ATT) policy last year. App tracking transparency is a measure that requires user consent when tracking personal information. It was a direct blow to the meta, which has been providing optimal and customized advertisements using massive big data as a weapon. This is because users were not likely to readily consent to information collection.

After Apple released iOS 14.5 last year, the results of a survey of US users showed that these concerns were not in vain. A Flurry Analytics survey in May of last year found that only 4% of US users consented to data tracking.

When Meta announced its earnings this time, it effectively acknowledged these concerns, saying, “We are concerned about a $10 billion loss in sales this year due to transparency in app tracking.”

Another reason to question Facebook’s growth potential is the ‘aging phenomenon of users’. Since when, Facebook has been criticized for being a ‘playground for fathers’. Young people flock to new social media like TikTok and Snapchat.

It is for this reason that the number of daily Facebook users in the fourth quarter of last year decreased for the first time in 16 years. This is because, in a situation where it is virtually saturated, there is no longer an influx of young people, raising questions about the future growth potential.

This is because, in the eyes of investors who are more interested in the future value than the present, the investment value of the meta may not be as high as expected.

■ Mark Zuckerberg’s ‘Metaverse First’ wasn’t a fuss

This uproar over the meta’s quarterly earnings clearly showed why Facebook had no choice but to declare ‘Metaverse First’ until it gave up on ‘the world’s best brand’ of Facebook.

This isn’t the first time Mark Zuckerberg has attempted ‘platform independence’. When Facebook launched ‘facebook home’ in 2013, it pursued an independent route in the mobile ecosystem dominated by Apple and Google. Facebook Home was a kind of ‘launcher’ program that optimizes the first screen of a smartphone for Facebook functions.

At the time, Zuckerberg emphasized that Facebook Home was not just an app, but the starting point of a new world. He explained that the smartphone will be fully integrated with Facebook, making the smartphone itself a Facebook-centric one.

Of course, Facebook’s attempt to become independent was unsuccessful. This is because ‘Facebook Home’ was too weak to replace iOS or Android.

Mark Zuckerberg’s release of ‘Metaverse First’ last year should be seen as an extension of this movement.

When Facebook declared ‘Metaverse First’ last year, American internet media Axios analyzed it as a signal of ‘the next-generation platform war’. It is explained that it is part of a huge ambition to change the grammar of competition altogether. Apple and Google are declarations of independence that they do not want to tolerate any longer being dominated by giant platforms.

■ The current state of the meta is very different from Google.

If we compare the meta with Google, we can understand the meaning of the current situation more clearly.

In Google, like Facebook, customized advertisements based on vast user information are an important source of revenue.

But Google differs from Facebook in two ways. Above all, Google’s search advertisements are information that users voluntarily input. The information users enter into the Google search engine to find something serves as the basis for targeted advertising. Unlike Facebook, it is valuable personal information that does not require consent.

The bigger difference is the business models of the two companies. Although Google also relies on iOS, it has its own mobile platform called Android, which is used by far more people. What’s more, Google pays Apple billions of dollars a year to embed its search engine into its Safari browser. Unlike Facebook, it maintains a relatively comfortable relationship with Apple.

This difference is reflected in the future performance of the two companies.

Meta’s stock fell nearly 26% after announcing a $10 billion revenue setback. Sales growth in the first quarter is also expected to remain in the 3-11% range. On the other hand, Alphabet, Google’s parent company, said it expects a 23% growth in the first quarter.

Through this fuss, Zuckerberg made it clear that the ‘Metaverse First Manifesto’ was not an unfounded adventure.

The judgment was not wrong, but the important thing is practice and performance. Reality Labs, which is in charge of the metaverse business in Meta, exceeded $10 billion in losses in 2021 alone. This is more than double the loss of Alphabet’s other divisions.

Will Zuckerberg be able to overcome this short-term pressure and succeed in another vision of ‘Metaverse First’? This question is likely to be the most important question that Zuckerberg will have to solve over the next two or three years.