At 15, Mark Cuban realized that he could profit from the philatelic market. Prices varied so widely and there were such inefficiencies that he discovered a way to buy 15-cent stamps and sell them for $25 an hour later to save for college.

The famous billionaire investor – he owns the NBA team Dallas Mavericks – already saw how collecting simply assigned a different value to a physical good, but now he believes in the revolution of NFTs (Non -Fungible Tokens), which are the digital version of stamps, art or any other tangible or intangible product to which a series of users end up conferring a value. These assets are gaining ground, and they are part of that new culture in which blockchain and cryptocurrencies are also fully integrated.

Gold is valuable because we all believe it is

Cuban reflected in early 2021 on this revolution of the new stores of value. Many speak of bitcoin as one of those stores of value that substitutes or can substitute for what gold has always represented, but for Cuban everything is actually part of the same idea.

And is that as he explained then, that gold has become the store of value par excellence is part of “a narrative. There are a lot of precious metals that meet the same requirements, but gold has more buyers. When the number Buyers go up, the price goes up, and vice versa. There is nothing unique or special about gold except for the fact that enough people believe that story and buy gold.”

It is the same reflection that other economists and analysts have made in the past. Yuval Noah Harari spoke about it in his bestseller ‘ Sapiens: from animals to gods ‘ and explained how the value of gold and silver “is purely cultural” and had become that reserve of value for perfectly fulfilling the requirement that it had “universal trust”. We place value on gold because so many other people (the majority of our world’s population) do.

NFTs (Non-Fungible Tokens)

The NFTs (Non-Fungible Tokens) are digital assets that are basically an extension of that same idea. Before we conferred value on tangible goods that we could touch and see (gold, stamps, works of art), and now we increasingly value intangible goods that we mostly see, but probably cannot touch.

Cryptocurrencies are an approximation to that principle, but NFTs go a little further and apply that concept of store of value to those objects more oriented to collecting.

A digital Pokémon letter is a good example of this new collectible stamp format, and the concept is the same as the one that became famous years ago with that surprising fever of cryptokitties (Cryptokitties) that are in fact still active and trading at prices that for many are absurd. Why did a digital avatar of a cat cost $ 115,000? Easy: enough people believed that its price was indeed that there’s no more.

What are NFTs and what characteristics do they have

Contrary to what happens with cryptocurrencies, NFTs cannot be exchanged with each other, since no two NFTs are alike: your letter from a crypto kitty is unique, as is that digital work of art or any other intangible good that comes in this definition.

As explained in Coindesk, there is a clear analogy between an NFT and a ticket for a music festival: in that ticket there is information about the buyer of the ticket, the date of the event and its location. Those inputs, like the NFTs, are personal and unique.

Most of these “tokens” (which can be coins, stamps, artworks, or cryptocats, for example) are based on the standards of the Ethereum network and its blockchain.

This has made it easy to operate with them when buying and selling them, and that services such as MetaMask or MyEtherWallet (wallets that allow interaction with Ethereum) are references in this type of transaction. In addition to this, NFTs have several characteristics:

- Strangely unique: these assets have many analogies with works of art, of which there may be copies (it is even easier to make copies of digital works), but here the owner can certify that he is the sole and actual owner of the original work, although it can be easily shared on the internet (and it does). It’s a curious situation and a shift in the value we place on physical and digital works of art.

- Non-interoperable: You cannot use a Cryptokitties avatar / card in other similar games like CryptoPunk.

- Indivisible: Unlike cryptocurrencies, NFTs cannot be divided into smaller pieces, and they have a full value as a full entity or token, without more. You can’t have 1/1000 of a crypto kitty.

- Indestructible: the data of an NFT is stored in the blockchain through a smart contract (Smart Contract), which makes it impossible to destroy, delete or replicate.

- Absolute ownership: unlike music or movies, if you buy one of these goods, your property is absolutely yours. You don’t buy a license to watch the movie or listen to the song, but that intangible asset is completely yours.

- Verifiable: the blockchain makes it possible to verify something that is much more complex to demonstrate or certify with topics such as art collecting or stamps, for example: the blockchain keeps a history of who has bought or sold an NFT and who is current (absolute) owner, including the original creator from whom that digital asset was purchased in the first place.

NFTs as the future of business

We return to Cuban, an absolute believer in this type of digital assets. In his opinion, NFTs are the future of business. “This generation knows that a digital contract and the digital asset that it represents or a crypto asset are a better investment than the traditional asset that you can see, touch or feel.”

That of course begins to make sense with this renewed boom that is being seen with cryptocurrencies and of which bitcoin and Ether are protagonists. Cryptocats have even been followed by memes like Nyan Cat, but in addition, NFTs are also beginning to have support even in very traditional segments, as the new auction organized by Christie’s auction house has shown.

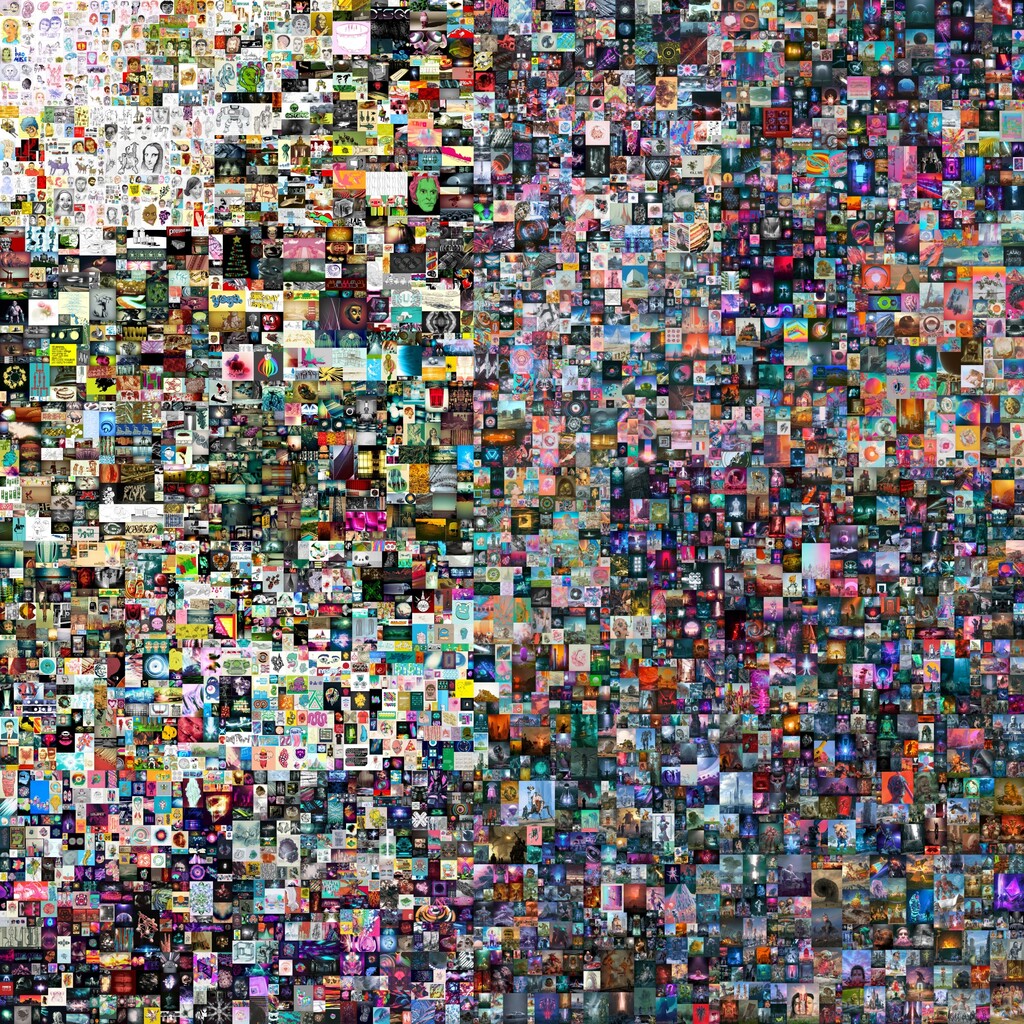

This house will auction a digital artwork called ‘Everydays: The First 5000 Days’ created by a celebrated artist named Mike Winkelmann, who is much better known by his alias, Beeple.

The work is a collage of more than 5,000 images created (one per day) by this artist in the last 13 years. The auction, by the way, must be paid in ETH, and at Christie’s they indicate both the address of the purse and that of the smart contract that validates and certifies that the work – an image of 21,069 x 21,069 pixels) is unique.

Beeple, who has made millions with his works, has now become the greatest exponent of that theoretical revolution that art and collecting could live with NFTs. And, as Cuban said, ” art is art. It has always been available in almost unlimited ways.”